When we buy a new car, the first thing we remember is how to protect it. An American insurance company is number one in the industry and its name is Progressive Auto Insurance. After many years of experience, due to long experiments, good ethics, and customer-oriented policies. Progressive Auto Insurance Company has made a lot of names and earned respect. In this article, we will discuss the topic of Progressive Auto Insurance: Comprehensive Coverage Tailored for You and why Progressive Auto Insurance is a top choice.

Why Choose Progressive Auto Insurance?

Progressive is a trailblazer in the auto insurance market, it is not just another insurance provider.

Competitive Pricing

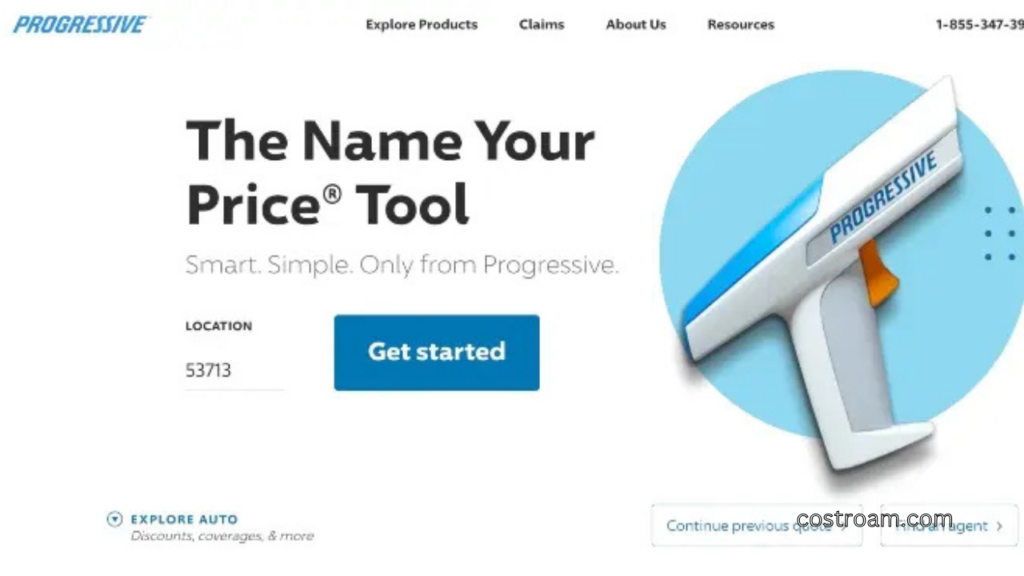

Progressive Company is not only an insurance company but also an innovative technology company. The company’s tool, the Name Your Price® Tool, allows customers to customize policies based on their needs.

Innovative Discounts

Progressive offers numerous discounts, including:

- Multi-policy Discounts: If you want to save money, combine auto insurance with your home or renters insurance.

- Safe Driver Discounts: Progressive Auto Insurance rewards those drivers who keep their fee record clean i.e. pay insurance fees on time.

- Usage-based Discounts: The Snapshot® program is a Progressive Auto Insurance program that tracks drivers’ habits. The Snapshot® program looks at how drivers are driving and offers reduced rates for safe practices.

Tailored Coverage Options

If you need or want any type of primary liability you need comprehensive coverage. So Progressive assures you that you are paying for what you need.

Comprehensive Coverage Options

Progressive does its best to cater to your diverse needs and provides several policies:

- Comprehensive Coverage:

Progressive covers damages, and injuries caused by natural disasters or non-collision events like theft, fire, or natural disasters. - Collision Coverage:

If there is an accident or your car gets hit by mistake, Progressive company pays for its repair. - Liability Coverage:

If there is an accident for which you are responsible or someone gets hurt because of you, this progressive protects you financially. - Roadside Assistance:

Progressive offers 24/7 towing and new tire assistance if your vehicle tires get damaged or punctured en route. - Uninsured/Underinsured Motorist Coverage:

If you have an accident with a driver who does not have adequate insurance, Progressive Auto Insurance protects you.

Progressive’s Unique Features

Snapshot® Program

This insurance option is designed for revolutionary use. This program looks at the driver’s habits and knows how they drive. And for those who drive safely, Snapshot® rewards safe driving with discounts.

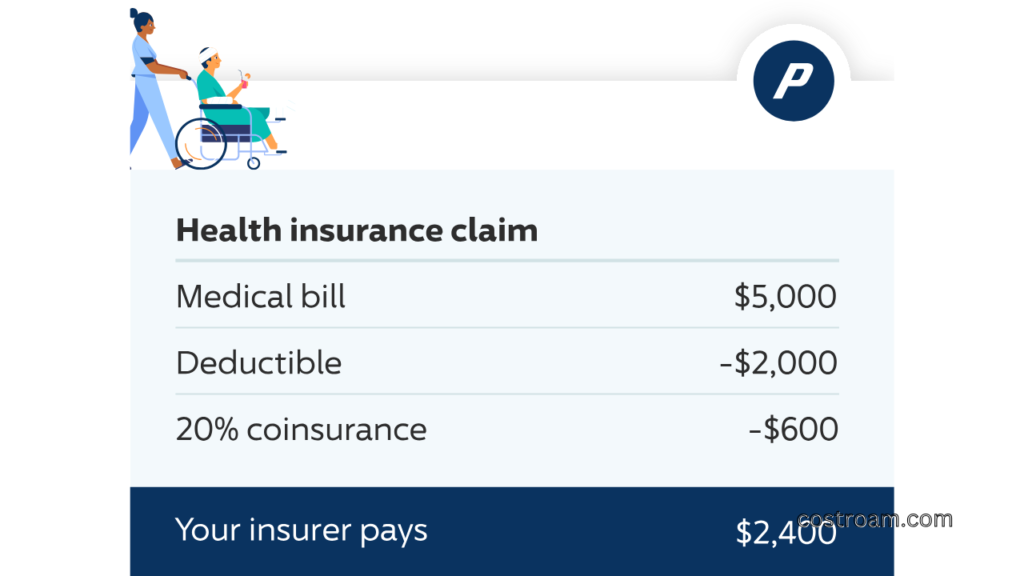

Deductible Savings Bank®

Progressive Deductible Savings Bank is an option when you go for car insurance every six months. The company allows you to get $50 towards your deductible, which is claim-free.

24/7 Customer Support

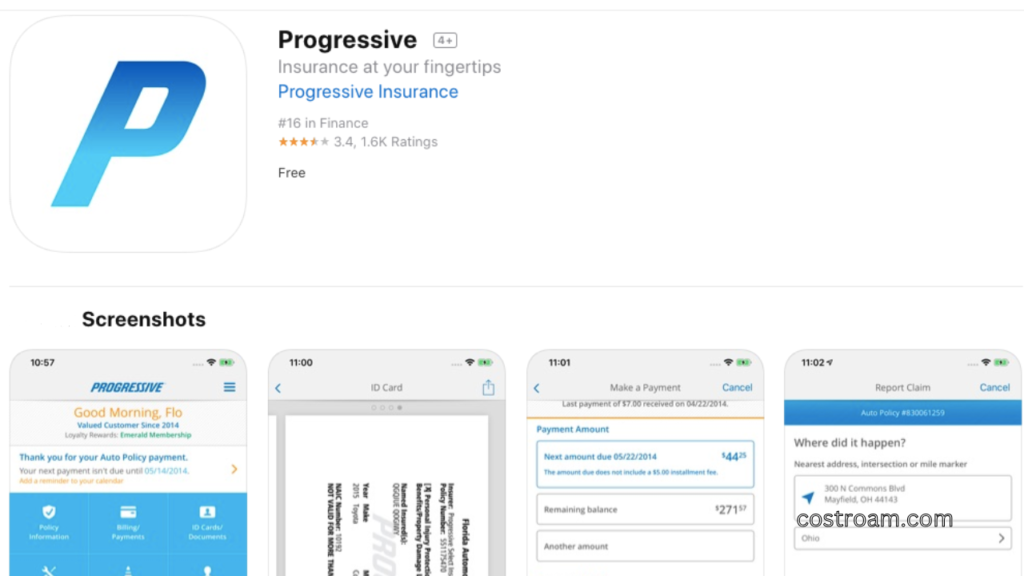

If you are in trouble and need help, Progressive can help you through its Mobile App or online website. It assures you that policy management is at your fingertips at any time.

Customer Experience

Progressive has won awards for its promise of good manners and comfort of use.

- Quick Claims Process

- There is a straightforward way to get a claim and they give a very clear update of the process.

- Strong Customer Support

- If you need information about Progressive Auto Insurance or have any questions or assistance, their representatives are always there for you.

Who Should Consider Progressive?

Progressive Auto Insurance caters to:

- First-time Drivers

- For new drivers who are driving for the first time and are young. Progressive Auto Insurance offers the best cheap plans and great discounts for young drivers.

- Families

- If you have a large home or a growing family and need more than one car, Progressive offers you discounts and flexible add-ons.

- High-risk Drivers

- Progressive also offers below-market rates for those with a less-than-perfect driving record.

Tips to Maximize Your Savings with Progressive

- Bundle Your Policies

- You can save a lot of money if you combine your homeowner or renter’s insurance with your vehicle insurance (Auto insurance).

- Drive Safely

- If you have good driving habits, you can save money by joining the Snapshot® program.

- Compare Regularly

- You should use the Progressive Compare Rates feature to get the best deal. So you can be sure that the deal you are getting is the best.

Why Progressive Is a Market Leader?

Progressive assures its customers in every way that they can make their insurance policy. Whether it is demanding advanced technology, flexible policies, or an excellent service. Progressive Auto Insurance continues to release its new policy program that offers discounts to new young drivers. And 24/7 support is provided to their members. And Progressive’s insurance rate is also lower than other companies.

Share this content: